SecurityKISS

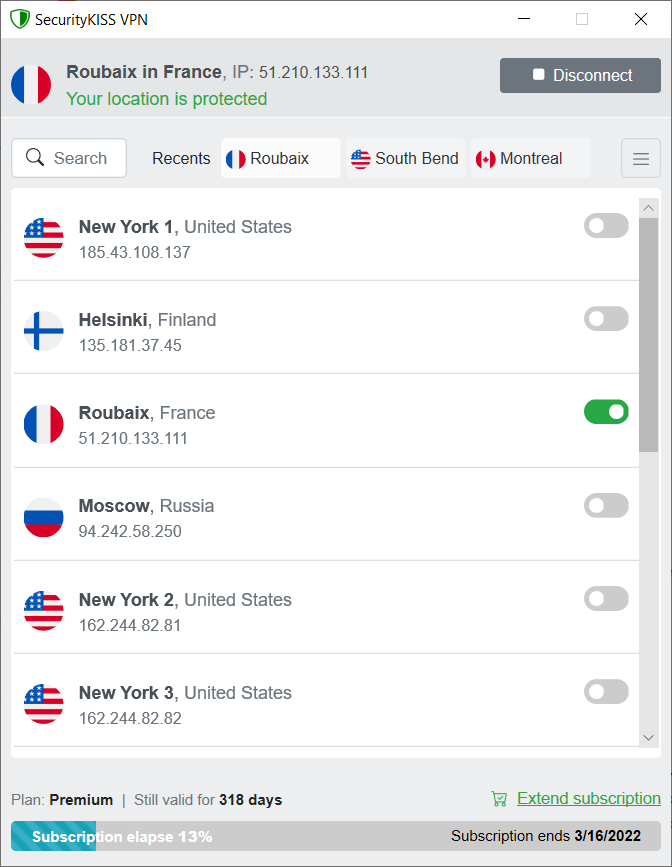

encrypts your internet traffic and tunnels it to our server

located in country of your choice.

No one can discover your real location,

no one can sniff your tunneled traffic.

Lightweight but smart application which just works

No ads, 100% clean! See reviews

Free plan available at full speed!